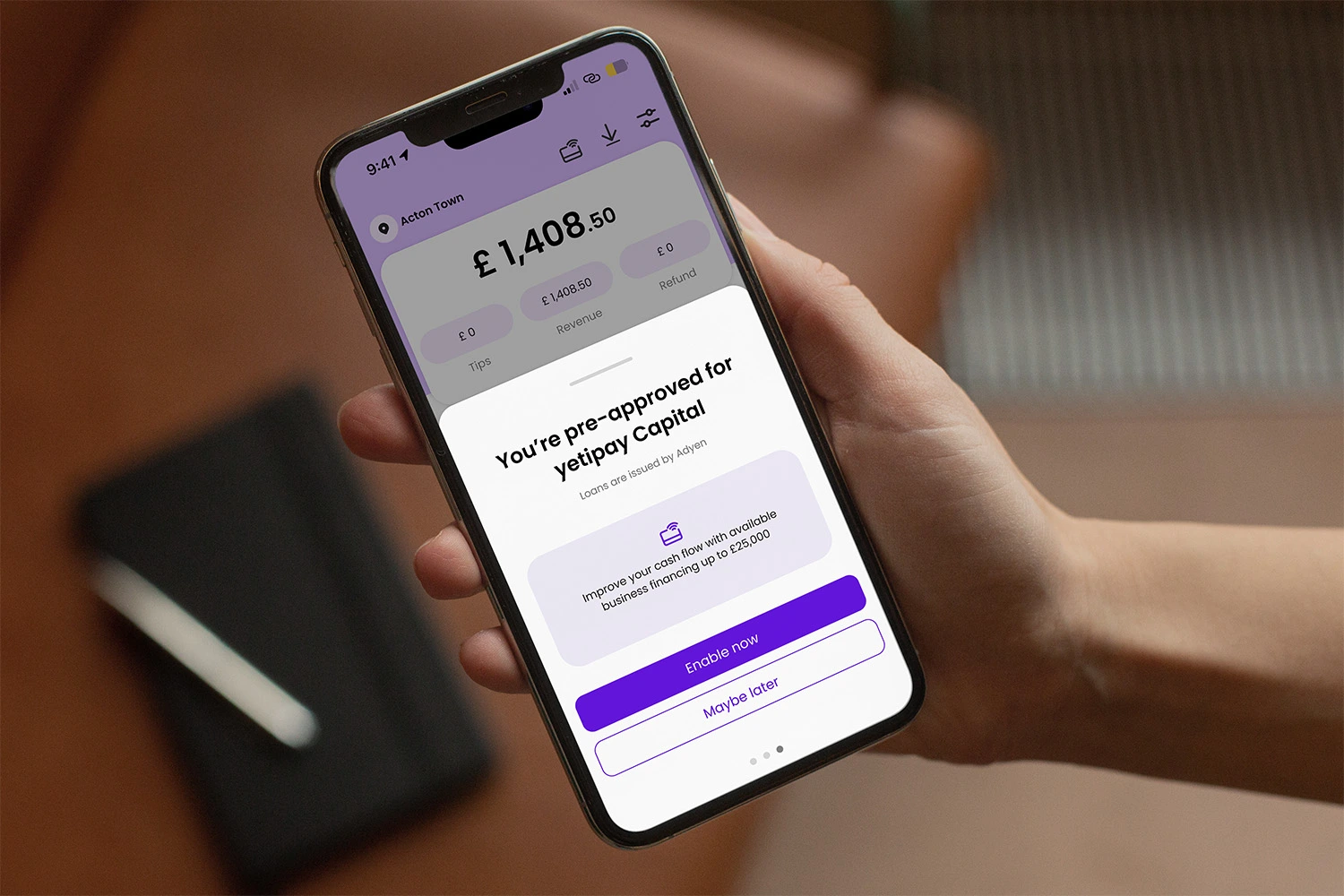

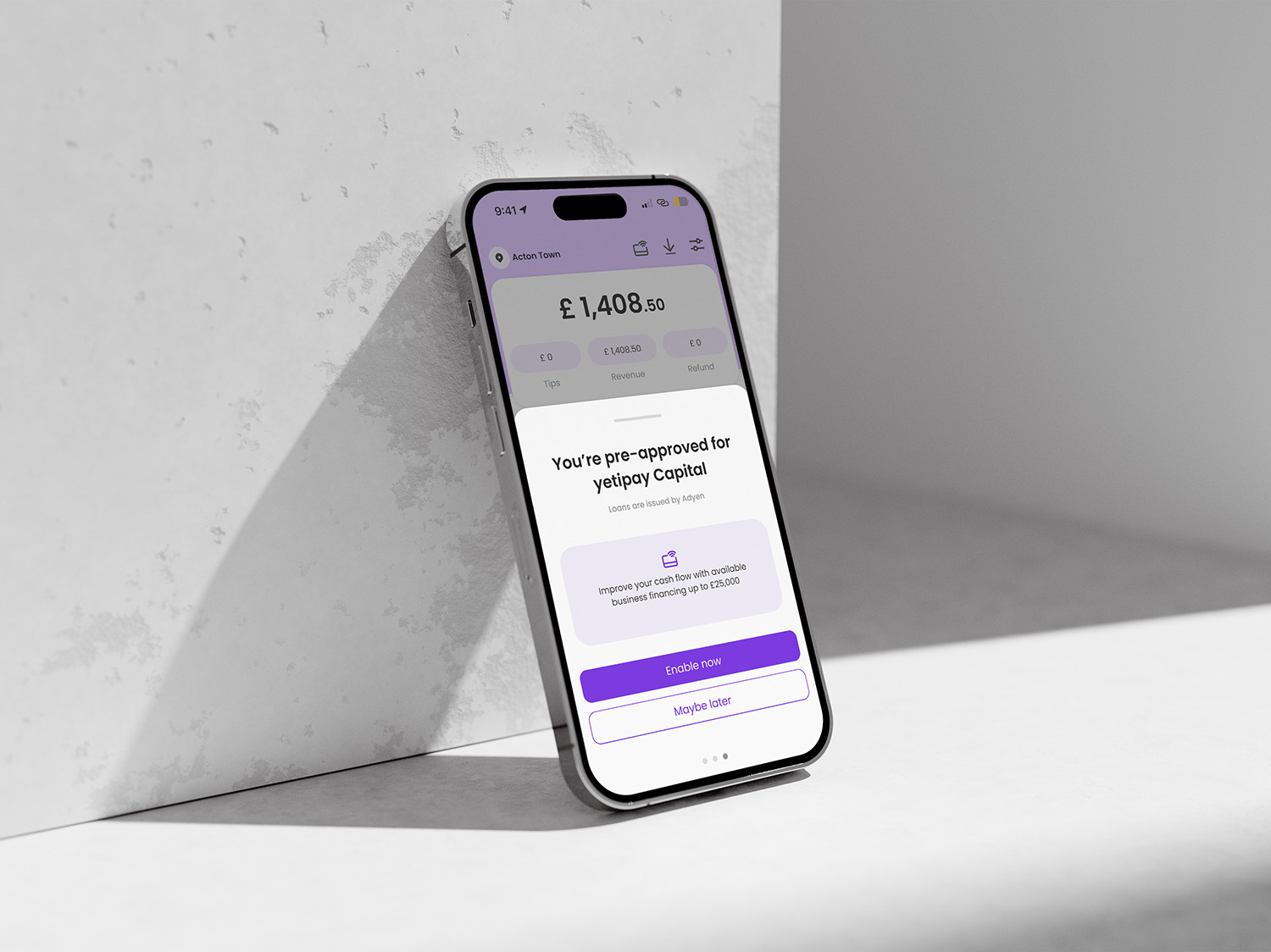

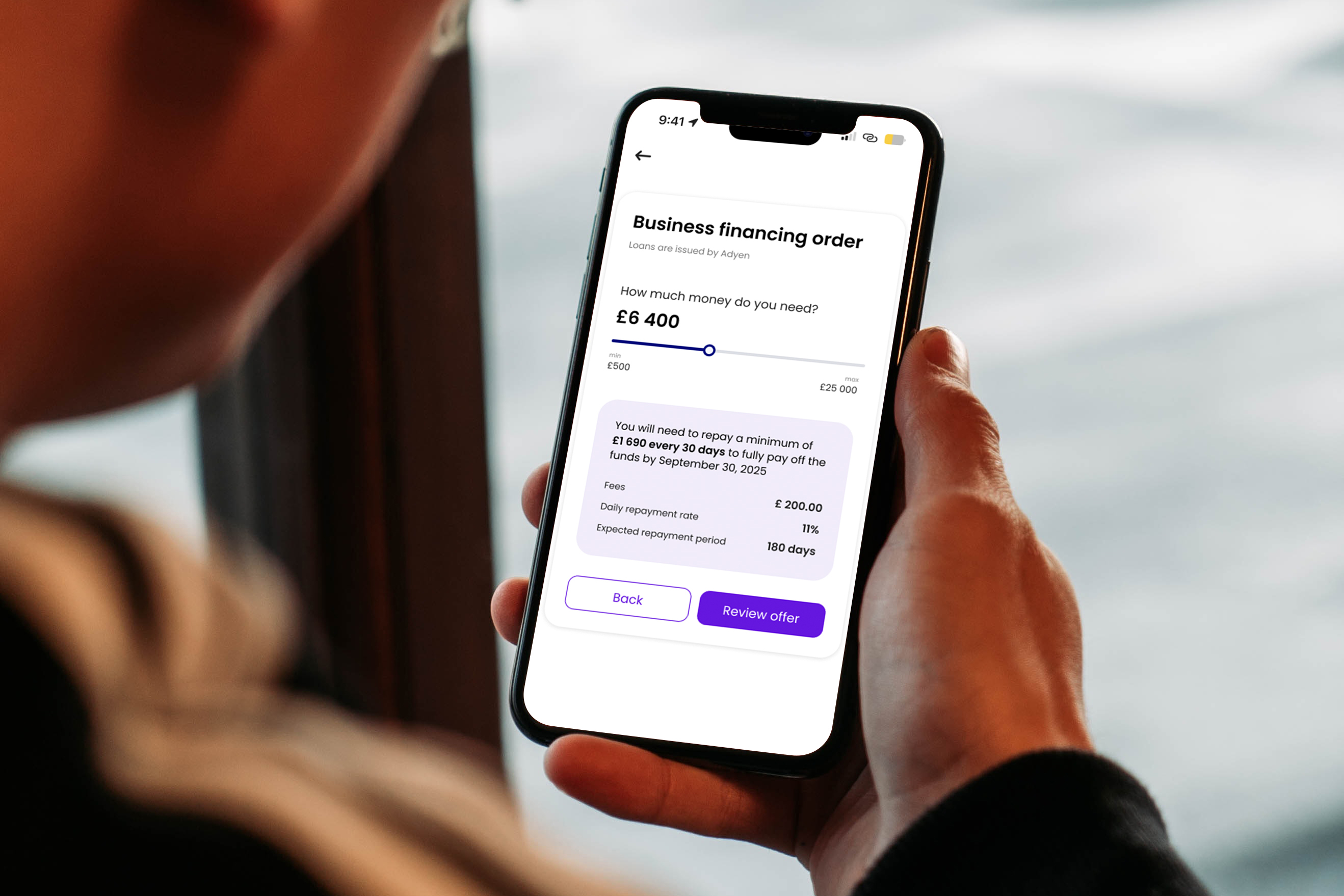

yetipay Capital makes business funding simple

With yetipay Capital, you get quick access to flexible business funding right from your yetipay app. No paperwork, no hidden fees, just clear personalised offers based on your sales history. Repayments flex with your takings, making it the stress free way to keep your business moving.

A smarter way to borrow

yetipay Capital makes funding feel simple with pre-approved offers and repayments that work alongside your cash flow not against it.

No forms or credit checks

Get personalised loan offers based on your card sales. No long applications or waiting for approvals.

Funds in your account fast*

Once you accept your offer, your money is typically sent the next working day. No chasing and no delays.

*May take up to two business days

Repayments that flex with you

We automatically deduct repayments from your daily sales so you pay more when you’re busy and less when you’re not.

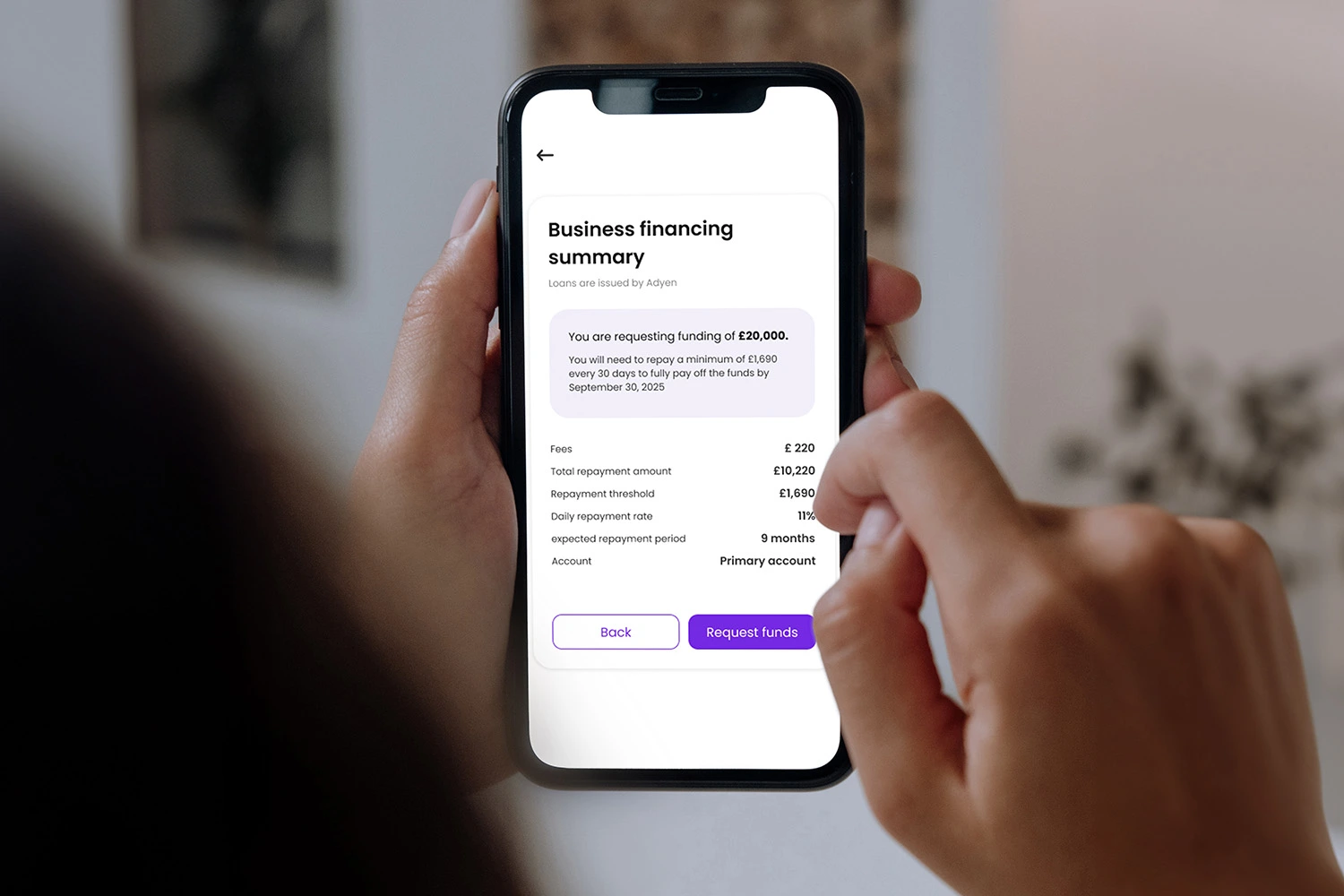

One simple fee no surprises

No hidden charges. Just one fixed fee agreed upfront.

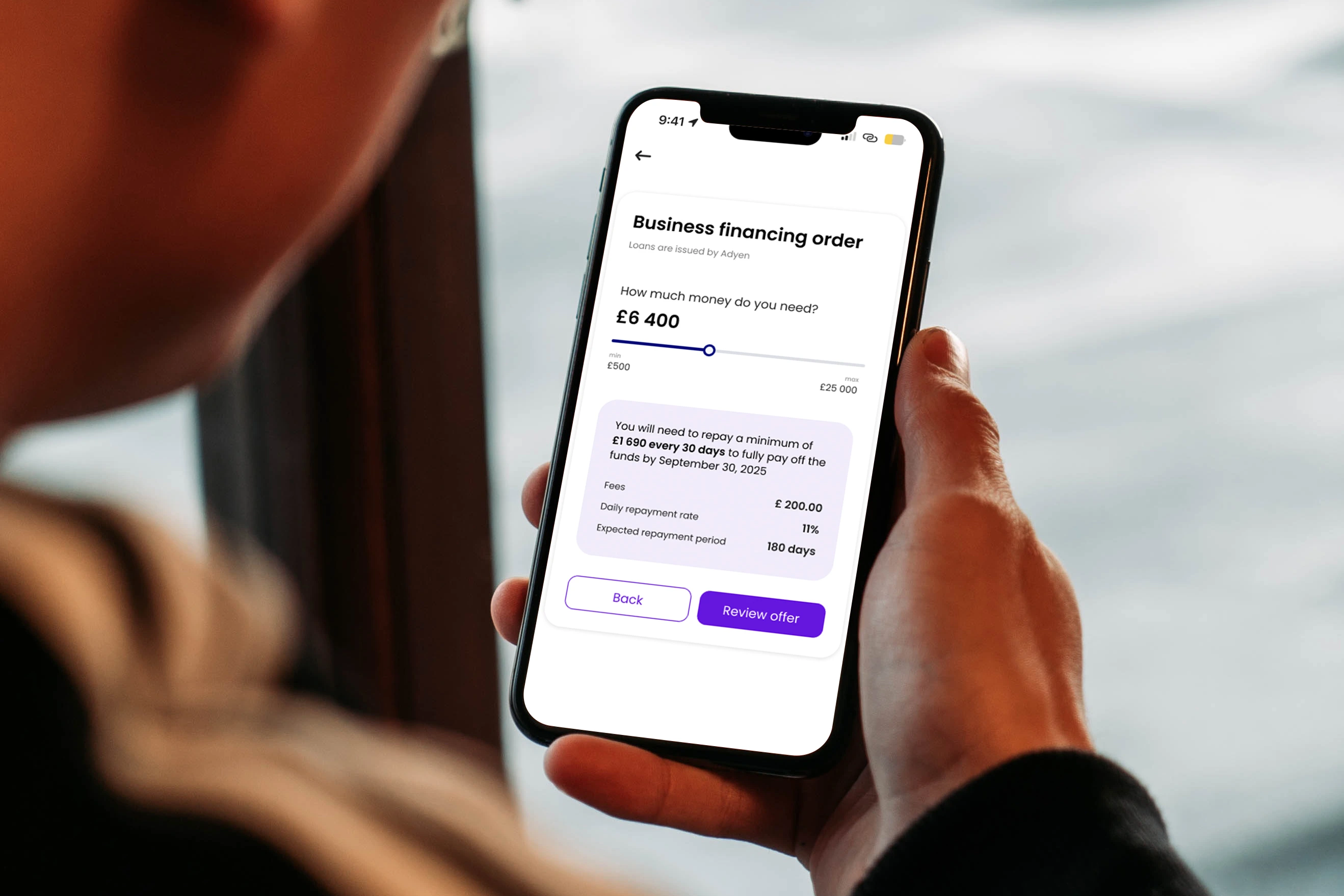

How does yetipay Capital work?

Getting started with yetipay Capital is easy. Log in to your yetipay app to see tailored business funding offers built around your sales history. Choose the option that fits your needs, accept the offer, and the money goes into your account within two business days. Repayments are taken automatically as a small percentage of your daily sales, so you only pay back when your customers pay you.

Frequently asked questions

Got questions? We’ve got answers to help you every step of the way.

yetipay Capital is a business finance option designed for small businesses already using yetipay. Eligible users receive personalised offers directly in the yetipay mobile app or Basecamp based on their card sales. There are no applications or credit checks. Just one fixed fee agreed upfront and repayments that flex with your daily takings.

Once you accept an offer the funds are sent to your business bank account typically by the next working day (although it may take up to two business days). Repayments are automatic. A fixed percentage of your daily card takings is used to repay the loan which means you pay more when business is busy and less when things are quiet. There are no fixed monthly payments.

yetipay Capital is powered by Adyen, a global financial technology platform and the lender of record. Adyen handles the funding regulatory compliance and repayment management while yetipay provides the front-end experience and ongoing customer support. This partnership means you are getting reliable secure access to funding through the platform you already use. Adyen Capital is issued by Adyen N.V. represented by its London Branch. Please note that Loans provided by Adyen do not qualify as regulated credit agreements under the Consumer Credit Act.

To be considered for yetipay Capital your business needs to be actively trading for at least three months. You need to accept card payments through yetipay and have a minimum of one thousand pounds in card sales per month. If you are eligible you will see a personalised offer in your yetipay dashboard. There is no application process. Everything is handled automatically.

The funds are yours to use for whatever your business needs. Whether that is buying stock, upgrading equipment, hiring staff or covering seasonal gaps. yetipay Capital is designed to support growth and help you manage your cash flow with confidence. There are no restrictions on how the loan is used as long as it supports your business operations.

Find out how much you could save

Tell us about your business, and we’ll create a free quote that shows how much you can save