Understanding Card Machine Costs

When it comes to using card machines for your business, it's vital to have a clear understanding of the associated costs. This will help you manage your budget effectively and avoid any hidden fees that might catch you off guard.

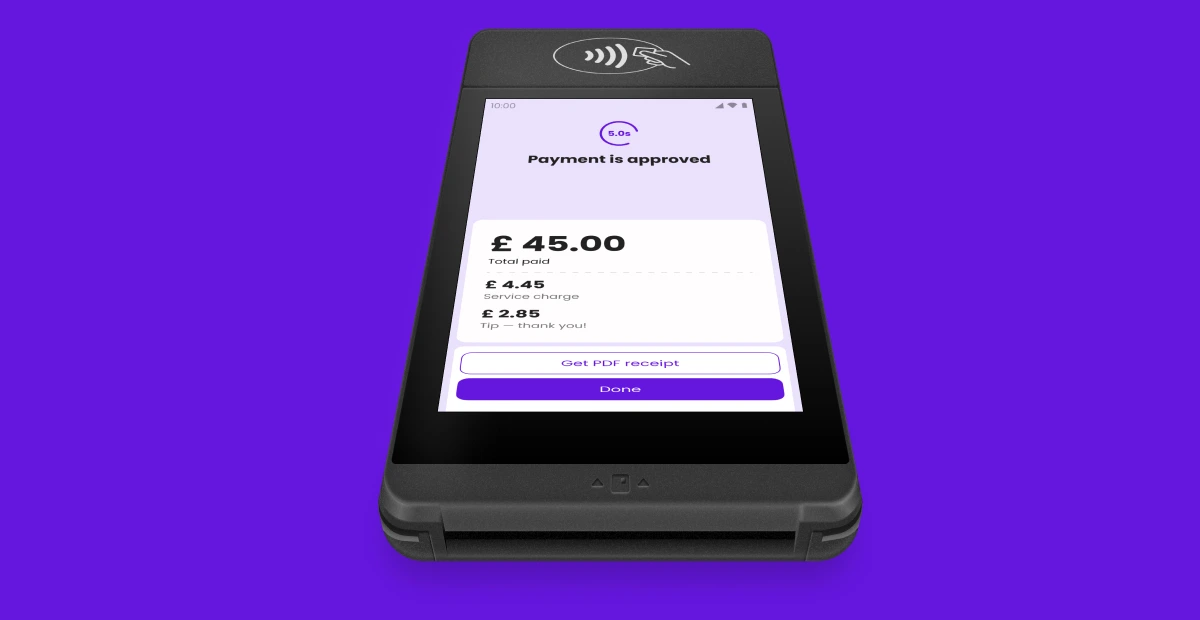

Overview of Transaction Fees

Transaction fees are the costs incurred each time a card payment is processed. These fees can vary based on several factors, including the type of card used, the transaction amount, and even the nature of your business. In the EU, interchange fees are capped at 0.3% for credit cards and 0.2% for debit cards (Wikipedia).

Here's a quick table to give you an overview of typical transaction fees:

You need to be aware of these charges as they can significantly impact your total costs.

Types of Card Machine Fees

Beyond transaction fees, there are various types of fees that you may encounter when using card machines. Some of these can be categorized as hidden fees, and it's essential to understand them to avoid unexpected charges.

Understanding these different fees will allow you to select a card machine provider that offers transparent pricing. Keep an eye out for services that provide affordable card machines and contractual options that help minimize costs in the long run. Be sure to look into how much a card machine will cost you overall, not just the visible fees. For additional tips on coping with card machine costs, check out our guide on reduce card machine costs.

Factors Affecting Card Machine Costs

Understanding the costs associated with card machines is crucial for managing your business expenses. Two significant factors affecting these costs are interchange fees and transaction types, as well as transaction volumes.

Interchange Fees and Regulations

Interchange Fees are charges made by card networks such as Visa and MasterCard whenever a card is processed by a merchant. These fees make up a significant portion of the costs associated with accepting card payments. In the EU, interchange fees are capped at 0.3% for credit cards and 0.2% for debit cards, which helps limit costs for businesses accepting card payments in the region. However, costs may vary depending on the sector, as some industries may face higher rates that are passed on by payment processors.

Different industries face varying interchange rates, which can add to your overall expenses. For example, some sectors may have higher rates that your payment processor might pass on to you.

Impact of Transaction Types and Volumes

The type of transaction can greatly influence the fees you incur. Different card types, such as credit, debit, and corporate cards, have distinct interchange rates. Likewise, the volume of transactions your business processes can also play a role in determining costs. Businesses that process a high volume of transactions may have the opportunity to negotiate reduced rates with payment processors, which can significantly lower your overall expenses in the long run.

If you are running a small business or a mobile trading operation, it's essential to examine your transaction patterns closely. Are you primarily processing small transactions or larger ones? Understanding your transaction landscape may help you find ways to optimise costs.

By comprehending these factors, you can keep an eye out for the hidden fees of card machines and make informed decisions to reduce overall operating expenses. For more guidance on costs, check out our articles on card machine costs and how much does a card machine cost.

Hidden Fees to Look Out For

As a small business owner, it's essential to keep an eye on the potential hidden fees that come with card machines. These extra costs can sneak up on you, affecting your bottom line. Here are some common hidden fees you should be aware of.

Monthly Minimum Fees

Monthly minimum fees are charged if you do not meet a certain threshold of transaction processing fees during the month. This means you could be charged a fee even if there are no transactions made. These fees can vary depending on the provider, so it’s essential to read the terms carefully.

Statement Fees

Statement fees can be another surprise. Many merchants don't anticipate these fees until they see them on their first bill. These costs are usually charged for the delivery of paper or electronic statement. If you're not careful, these can accumulate over time.

It's wise to check if your provider charges for statements; switching to electronic statements might save you some costs.

PCI Non-Compliance Fees

Ensuring your business maintains PCI compliance is crucial. Merchants that fail to do so may face monthly non-compliance fees, potentially leading to substantial costs. To remain compliant, you'll need to complete the PCI self-assessment questionnaire (SAQ).

By being aware of these hidden fees, you can make more informed decisions regarding your payment solutions. Understanding all the costs associated with card machines ensures that you keep your expenses manageable while focusing on growing your business. For more information on tackling these costs, visit our card machine costs page.

Strategies to Minimise Costs

Managing costs associated with card machines can be challenging, but there are several effective strategies you can adopt to reduce hidden fees and overall expenses. Here are some tactics to consider:

Negotiating Reduced Rates

If your business has a history of sales or experiences a high volume of transactions, you might have the leverage to negotiate better rates with your payment processor. Engaging in discussions about your fees can lead to significant savings. It's worth researching the average rates charged in your industry to provide a benchmark during negotiations. This way, you can make a strong case for lower rates. For additional information on costs, visit our article on card machine costs.

Encouraging Debit Card Usage

Another effective way to minimise transaction costs is to encourage your customers to use debit cards instead of credit cards. Debit card transactions typically incur lower fees than credit card transactions. For some businesses, this can mean saving between 0.5% and 1.5% on each transaction. You might consider offering incentives, such as discounts or loyalty rewards, for customers who choose to pay with debit cards. Implementing these incentives could make a noticeable difference in your overall transaction fees. For more ideas on optimising costs, check our guide on reduce card machine costs.

Industry-specific Interchange Fees

It's important to understand that interchange fees can vary based on the type of card and the industry you're operating in. In the EU, for example, interchange fees are capped at 0.3% for credit cards and 0.2% for debit cards, which can help reduce costs for businesses accepting payments in these regions. These rates may differ in other regions, with some industries having higher fees that are passed on to merchants by payment processors.

Different transaction methods, such as online or in-store, also affect fees. For example, online transactions can have higher costs due to additional security measures. Being conscious of these factors and adjusting your business strategies accordingly can help you save money in the long run. For more details on associated fees, visit our article on card machine transaction fees.

By implementing these strategies, you can effectively reduce hidden fees and ensure your payment process remains hassle-free and cost-effective.